PREPARATION OF FINANCIAL STATEMENTS

The prime objective of accounting is to ascertain how much profit or loss a business organisation has made during any accounting period and to determine its financial position on a given date. Preparing final accounts or financial statements serve this purpose. After the preparation of Trial Balance, the next level of work in accounting is called “Final Accounts” level. Preparation of Final Accounts involves the following:

- Preparation of a Trading Account

- Preparation of a Profit & Loss Account and

- Preparation of a Balance Sheet

Trial balance provides the essential input for the preparation of these accounts or statements. These accounts / statements provide necessary information to various interested groups such as shareholders, investors, creditors, employees, management and

government agencies etc. Therefore, these financial statements are prepared to serve the information needs of these diverse groups to enable them to make appropriate decisions.

1. TRADING ACCOUNT

Trading Account is prepared to know the outcome of a trading operation. Trading Account is made with the chief intention of calculating the gross profit or gross loss of a business establishment during an accounting period, which is generally a year.

In accounting phraseology, gross profit means overall profit. Gross profit is the difference between sale proceeds of a particular period and the cost of the goods actually sold. Since gross profit means overall profit, no deduction of any sort, i.e. general, administrative or selling and distribution expenses is made.

Gross Profit is said to be made when the sale proceeds exceed the cost of goods sold. On the contrary, if the cost price of the goods is more than the selling price, then we can say that there is a loss.

In order to illustrate how the gross profit is ascertained, knowledge of format of the Trading Account is very important. This gives a clear presentation of how the gross profit is calculated.

A Trading Account is prepared in “T” form just like every other account is prepared. Though it is an account, it is not just an ordinary ledger account. It is one of the two accounts which are prepared only once in an accounting period to ascertain the profit or loss of the business. Because this account is made only once in a year, no date or journal folio column is provided.

eg.

Items of Trading Account

Dr. side:

- Opening stock

- Purchases

- Purchases returns

- Direct expenses

Cr. side:

- Sales

- Sales returns

- Abnormal loss

- Closing stock

After recording the above items in the respective sides of the Trading Account, the balance is calculated to ascertain Gross Profit or Gross Loss. If the total of credit side is more than that of the debit side, the excess represents Gross Profit. Conversely, if the total of debit side is more than that of the credit side, the excess represents Gross Loss.

Gross Profit is transferred to the credit side of the Profit & Loss Account and Gross Loss is transferred to the debit side of the Profit & Loss Account.

2. PROFIT AND LOSS ACCOUNT

After preparing Trading Account, the subsequent step is to prepare Profit & Loss Account with a view to ascertain net profit or net loss during an accounting period.

The Profit & Loss Account can be defined as a report that summarizes the revenues and expenses of an accounting period. The objective of the income statement is to explain to the managers and investors whether the company made or lost money during the period being reported. As pointed out earlier, the balance of the Trading Account (gross profit or gross loss) is transferred to the Profit & Loss Account.

eg.

Items of Profit and Loss Account

Dr. side

- Management Expenses

- Selling and Distribution Expenses

- Maintenance Expenses

- Financial Expenses

- Abnormal Losses

- Expenses incurred and paid out in that year

- Expenses incurred but not paid out, partly or fully, during the current year

- Expenses paid for during the current year, but not incurred as yet, partly or fully

- Expenses of the current year, likely to arise in subsequent period

Cr. side

- Gross Profit

- Other Incomes

- Non-trading Income

- Abnormal Gains

The next step in preparation of Profit and Loss Account is the balancing of the account. The totals of debit side and credit side are computed and the difference between these totals is either a net profit or net loss.

If the total of debit side exceeds the total of credit side, there is a net loss, whereas when the total of credit side exceeds the total of debit side, there is a net profit.

Net Profit is the last item to be recorded on debit side; else, net loss is the last item on credit side. After computing net profit/loss, the totals of two sides of the account match.

* Trading account is the account showing the Gross Profit of a business, whereas the Profit & Loss Account shows the Net Profit of a business.

- Gross Profit = Sales Turnover - Cost of goods sold (opening stock + purchases + carriage inwards - closing stock)

- Net Profit = Gross Profit + Revenue (rent received, interest received, discount received) - Expenses

*All direct expenses/revenues that are directly related to the factory or production are included in a Trading A/c. On the other hand, all Indirect Expenses/revenues that are related to the Administration & Selling are included in a Profit and Loss A/c.

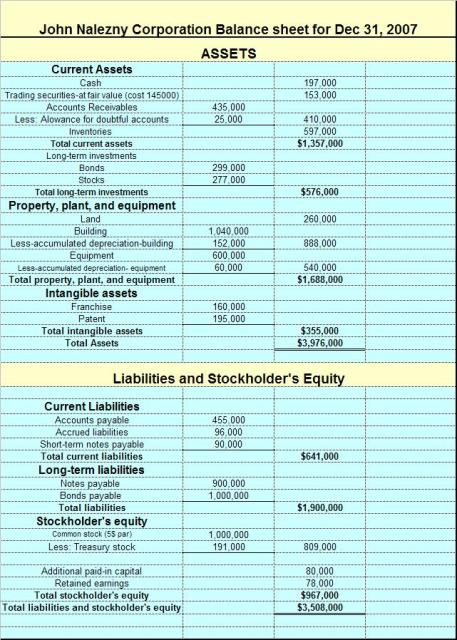

3. BALANCE SHEET

A Balance Sheet (or statement of financial position) is a summary of the financial balances of a sole proprietorship, a business partnership or a company. Assets, liabilities and ownership equity are listed as of a specific date, such as the end of the financial year.

The Process of preparation and presentation of Balance Sheet involves two steps:

- Grouping

- Marshaling

In the first step, the different items to be shown as assets and liabilities in the Balance Sheet are grouped appropriately. For this purpose, items of similar nature are grouped under one head so that the Balance Sheet could convey an honest and true message to its users.

eg.

- Stock, debtors, bills receivables, Bank, Cash in Hand etc are grouped under the heading Current Assets.

- Land and Building, Plant and Machinery, Furniture and Fixtures, Tools and Equipment under Fixed Assets.

The second step involves sequential arrangement of all the assets and liabilities in the Balance Sheet. There are two

methods of presentation:

- The order of liquidity

- The order of permanence

(liquidity - The ability to convert an assets to cash quickly.)

(permanence - The useful life of the asset or liability.)

eg.

0 comments:

Post a Comment